|

[VIEWED 7043

TIMES]

|

SAVE! for ease of future access.

|

|

|

|

devilwithin999

Please log in to subscribe to devilwithin999's postings.

Posted on 03-21-09 10:44

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

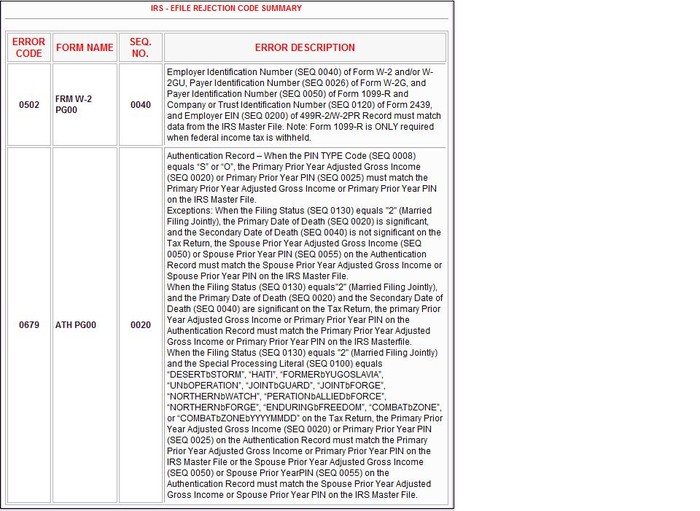

Hi, I efiled my tax return. It got rejected and showed the following errors. I dont understand what the hell is that. So plz sajha tax gurus, plz help me. Here is what is says:

|

| |

|

|

|

|

devilwithin999

Please log in to subscribe to devilwithin999's postings.

Posted on 03-22-09 12:59

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Any help plz!!! I am really into trouble. Aba tax return ko paisa aayena bhane ta barbad huncha.

|

| |

|

|

syanjali

Please log in to subscribe to syanjali's postings.

Posted on 03-22-09 2:28

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Nope; Couple things may have happened. You should write a liittle bit in details so we can advise appropriatly. It looks you filed an E-file, while you efile it always ask for either pin number or AGI of privious year. Either you got the wrong printed EIN number W-2 form or you input worng one and you did not furnish the correct AGI for efile. What should you do? Review every thing throughly, have you previous year 1040 infornt of you. Give all information it asks for efile, send it again. BAM, Refund is in your bank account withing 15 days.

|

| |

|

|

syanjali

Please log in to subscribe to syanjali's postings.

Posted on 03-22-09 2:28

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Nope; Couple things may have happened. You should write a liittle bit in details so we can advise appropriatly. It looks you filed an E-file, while you efile it always ask for either pin number or AGI of privious year. Either you got the wrong printed EIN number W-2 form or you input worng one and you did not furnish the correct AGI for efile. What should you do? Review every thing throughly, have you previous year 1040 infornt of you. Give all information it asks for efile, send it again. BAM, Refund is in your bank account withing 15 days.

|

| |

|

|

my_nepal

Please log in to subscribe to my_nepal's postings.

Posted on 03-22-09 3:38

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

mainly check ta identification number you place from w2 form ... ssn should also match ........ just review bro you will get the moneyyyyyyyyyyyyyyyyyyy

|

| |

|

|

devilwithin999

Please log in to subscribe to devilwithin999's postings.

Posted on 03-22-09 4:49

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

I efiled from Olt taxes.com so aba yo reject bhaye pachi maile tesbatai garnu parcha ki I can efile from tax slayer again.? Thanks guys

|

| |

|

|

syanjali

Please log in to subscribe to syanjali's postings.

Posted on 03-22-09 5:39

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Yes, just revise , some thing is posted incorrect, resend it. I suggest TaxAct.com, Simple as Turbo and pay less.

|

| |

|

|

devilwithin999

Please log in to subscribe to devilwithin999's postings.

Posted on 03-22-09 6:37

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

So its not necessary to refile from olt.com but instead I can use any tax filing website?

|

| |

|

|

devilwithin999

Please log in to subscribe to devilwithin999's postings.

Posted on 03-23-09 8:00

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Plz reply my last question. Thanks

|

| |

|

|

GuitarDaku

Please log in to subscribe to GuitarDaku's postings.

Posted on 03-23-09 9:14

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

the first error looks like some typo on somebody's part (probably yours). I think the second error occurred because you don't have a pin from last year. Do you have it? Do you know what it is? Btw, if you have a significant amount coming, use turbotax. And you can change the service as long as it has not been submitted (which is the case so you can still do it.) I filed mine through turbotax (which i did last year too) about a month ago and have gotten fed and state both.

|

| |

|

|

syanjali

Please log in to subscribe to syanjali's postings.

Posted on 03-24-09 7:50

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Log in the tax preperation web you had submitted your efile. You made some errors. Review all, starting from your name and so on. Efile again, you do not need to pay again if you use the same tax preperation software. You did not put certain numbers correctly that is the reason of rejection. Did your state tax rejected too? If you want to pay extra you can use other software, but advise to use the same you had used last time.

|

| |

|

|

abhishesh

Please log in to subscribe to abhishesh's postings.

Posted on 03-25-09 12:47

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

why woun't u try turbotax.com

|

| |

|

|

devilwithin999

Please log in to subscribe to devilwithin999's postings.

Posted on 03-25-09 2:31

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Ok I found out the problem. The people from my employment company wrote my last name wrong. Its Brestha instead of Shrestha. Thats why my EIN got wrong. So what should I do in that case? Ask for new W-2 but will it also be updated in IRS? Thanks

|

| |

|

|

syanjali

Please log in to subscribe to syanjali's postings.

Posted on 03-25-09 10:09

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Good luck, you find out the reason of rejection. Now fix it by yourself. How you do it, talk to your HR. HR will sent you a correted W_2 as well to IRS. Await until you get that. How you missed it????

|

| |